How Credit Repair Helps Consumers Regain Control of Their Financial Life

A strong credit score is one of the most valuable financial tools anyone can have. It affects everything—loan approvals, interest rates, renting an apartment, buying a car, and even qualifying for certain careers. But many people find themselves stuck with low credit scores due to errors on their report, past financial challenges, or a lack of guidance. This is where credit repair comes into the picture, offering a structured and effective way to rebuild financial confidence.

Credit repair focuses on identifying mistakes, correcting inaccurate entries, and helping consumers understand what truly impacts their credit score. As more people educate themselves about credit health, the demand for reliable credit repair services has grown significantly. Alongside this growth, marketers and financial influencers are tapping into the opportunity through a credit repair affiliate program, which allows them to earn by referring clients to trusted credit repair companies.

Why Credit Repair Is So Important Today

Financial systems are becoming more credit-driven every year. Even basic services—like phone contracts or utility deposits—often depend on credit checks. When a credit report contains errors such as wrong balances, outdated information, or fraudulent accounts, consumers end up paying higher costs or getting denied completely.

Credit repair services help by:

-

Reviewing credit reports from all major bureaus

-

Identifying inaccurate, unverifiable, or outdated items

-

Filing disputes on behalf of the consumer

-

Following up with bureaus for corrections

-

Educating consumers on building healthy credit habits

By correcting errors and developing better financial behaviors, individuals can gradually raise their score and unlock better financial opportunities.

Growing Consumer Interest in Credit Repair

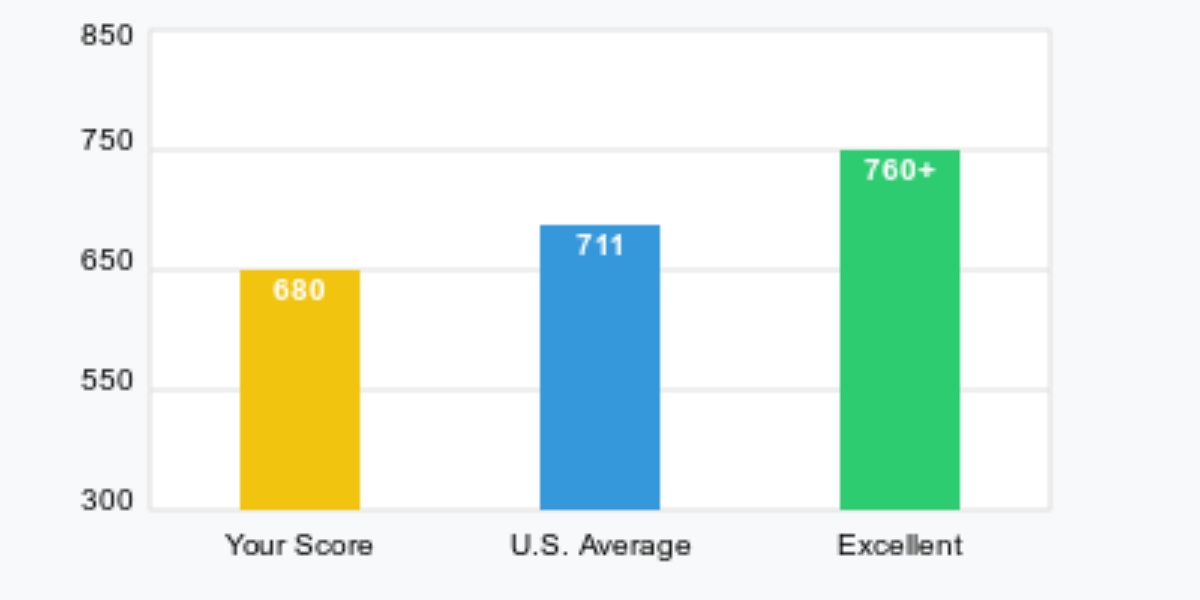

As inflation rises and lending standards tighten, people are more aware of how vital their credit score is. A better score can lower interest payments by thousands of dollars over the life of a loan. Because of this, more consumers are seeking help from credit repair companies.

This surge in demand has also given rise to new marketing opportunities, especially through joining a credit repair affiliate program. Affiliates can earn commissions simply by guiding people toward reputable credit repair services that can truly make a difference in their financial lives.

How a Credit Repair Affiliate Program Works

A credit repair affiliate program enables bloggers, YouTubers, influencers, and financial educators to promote credit repair services through unique tracking links. When someone signs up, the affiliate earns a commission.

Why these programs are thriving:

-

High demand for credit repair

-

Free and easy sign-up

-

Strong earning potential

-

Evergreen niche with huge search volume

-

Ready-made marketing tools provided by companies

Affiliates get to help people improve their financial situation while building a meaningful online income stream.

The Real Value of Credit Repair

Credit repair is more than just fixing errors—it gives people a second chance. It helps them qualify for better insurance rates, access new credit responsibly, and build long-term financial stability. At the same time, affiliates who promote trusted services play a role in connecting consumers with valuable support.

As financial systems become increasingly credit-dependent, both consumers and affiliates benefit from being part of the broader credit repair ecosystem.

Final Thoughts

Credit repair is becoming an essential service for anyone looking to improve their financial future. As awareness grows, both the industry and affiliate opportunities continue to expand. For those looking to earn online while helping others, joining a credit repair affiliate program is a promising and impactful path.