Economic Recovery and the Role of Precious Metals: A Long-Term Solution

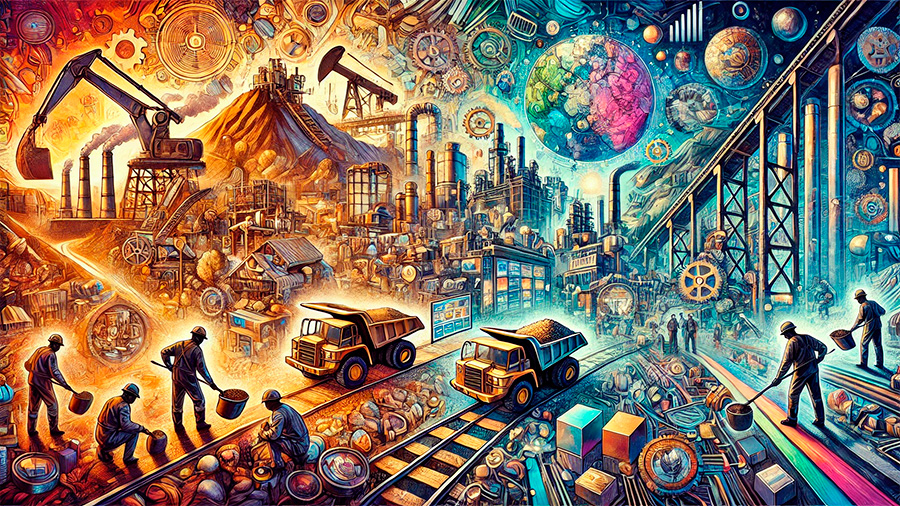

In times of economic crisis, nations and businesses alike seek ways to stimulate recovery and stabilize their financial systems. One of the key assets that play a critical role in these recovery efforts is precious metals. Gold, silver, platinum, and other precious metals are not only valuable commodities in their own right but also serve as important drivers of economic recovery, especially after periods of instability or recession. In this article, we explore how the mining and trade of precious metals contribute to economic recovery after crises, providing a crucial link between market stability, industrial demand, and investment opportunities.

The Role of Precious Metals in Economic Recovery

Precious metals have long been recognized as safe-haven assets during periods of economic uncertainty. As countries grapple with the aftermath of financial crises, geopolitical instability, or environmental disasters, precious metals offer a tangible, reliable store of value. They help stabilize economies by providing an alternative to volatile currencies, offering both short-term relief and long-term growth potential.

1. Safe-Haven Asset During Crises

Precious metals, particularly gold, are often seen as a safe-haven investment during times of economic turmoil. When currencies fluctuate, inflation rises, or stock markets experience volatility, investors turn to precious metals as a reliable store of value. The demand for gold and silver, in particular, spikes during crises, with these metals maintaining their value even when traditional investments like stocks or bonds falter.

How precious metals act as a safe-haven asset:

- Market stability: Gold and silver are not tied to the performance of any one currency or market, making them less susceptible to market crashes or inflationary pressures.

- Long-term store of value: Throughout history, precious metals have consistently held their value, which reassures investors and governments during financial crises.

- Demand surge during uncertainty: When economic conditions worsen, investors flock to precious metals to preserve wealth, driving up prices and stabilizing markets.

2. Boosting Industrial Demand and Job Creation

The mining and trade of precious metals are critical to the industrial sectors that rely on these materials for manufacturing and technological development. For instance, platinum and palladium are key to the automotive and electronics industries, while gold is heavily used in electronics, medical devices, and jewelry. As demand for these metals increases, mining operations expand, leading to job creation, technological advancement, and greater industrial production—key components of economic recovery.

How precious metal mining supports industrial growth:

- Job creation: Precious metal mining creates thousands of jobs, from extraction and processing to logistics and administration. As mining operations ramp up, new employment opportunities emerge, which is essential for economic recovery.

- Technological innovation: The demand for precious metals often drives innovation in mining techniques, resource extraction technologies, and industrial applications, helping boost overall productivity in the economy.

- Revitalizing local economies: Mining operations often have a significant economic impact on local communities, where they provide critical infrastructure, wages, and support for surrounding businesses.

3. Trade and Export Revenues for Economic Stability

Countries rich in precious metal resources benefit from trade and export revenues, which play a crucial role in economic recovery. Exporting precious metals provides foreign exchange reserves that help stabilize national currencies and finance government recovery programs. The global trade in precious metals, particularly gold, is a vital part of the international economic system and supports countries’ balance of payments, especially during times of crisis.

How precious metals contribute to global trade:

- Foreign exchange reserves: Precious metals, particularly gold, are considered a strong asset for foreign reserves. When countries export precious metals, they increase their reserves, which can stabilize their currency and improve their credit rating.

- Support for global trade: As global demand for precious metals rises, countries that are major exporters (such as South Africa, Russia, and Australia) experience increased trade revenue, which boosts their economy.

- Fiscal stability: Governments can use revenues from the export of precious metals to fund recovery programs, pay down national debt, or reinvest in infrastructure projects that stimulate economic growth.

Precious Metals as a Long-Term Investment for Economic Resilience

In addition to serving as a safe-haven during crises, precious metals play a long-term role in fostering economic resilience. They provide a diversified investment avenue that can help individual investors, businesses, and governments hedge against the risks associated with economic downturns.

1. Diversification and Risk Management

For investors, precious metals offer a unique opportunity for diversification. Precious metals are considered non-correlated assets, meaning their prices often move independently of traditional asset classes like stocks and bonds. This characteristic makes them an essential part of a well-balanced portfolio, allowing investors to hedge against economic volatility and market downturns.

How precious metals improve investment portfolios:

- Diversification benefits: Adding precious metals to a portfolio helps reduce overall risk, as they tend to perform well when other assets underperform.

- Protection against inflation: As inflation rises, the value of fiat currencies typically declines. Precious metals, however, tend to retain or increase in value, providing a hedge against inflation.

- Wealth preservation: In times of economic instability, precious metals provide investors with a safe means of preserving wealth, even as other assets fluctuate or lose value.

2. Government and Institutional Investment in Precious Metals

Governments and central banks also rely on precious metals, particularly gold, to secure long-term economic stability. By increasing their holdings of precious metals, central banks can ensure that their national economies are resilient to global economic shocks and currency devaluation. The increasing role of precious metals in sovereign wealth funds and reserve assets has cemented their place as a cornerstone of global financial systems.

Government investment strategies in precious metals:

- Building reserves: Many countries increase their gold reserves during times of economic uncertainty as part of their fiscal policy, ensuring that their financial systems remain stable.

- Supporting financial sovereignty: Governments use precious metals as a safeguard against reliance on foreign currencies, which is especially important during global economic crises.

- Institutional investment: Sovereign wealth funds and institutional investors often hold significant amounts of precious metals to protect their portfolios from currency fluctuations and financial instability.

Challenges Facing Precious Metal Markets During Recovery

While precious metals play a crucial role in economic recovery, there are challenges that can affect their effectiveness. Market volatility, political instability, and changes in global demand can all have a significant impact on the price and availability of precious metals.

1. Market Volatility

The prices of precious metals can be highly volatile, particularly during periods of economic recovery or instability. Factors such as changes in interest rates, inflation expectations, and market sentiment can cause significant fluctuations in precious metal prices, which can hinder their effectiveness as a long-term economic recovery tool.

Challenges of price volatility:

- Speculative trading: The prices of precious metals are often influenced by speculative trading, which can result in sharp price movements and reduce market stability.

- Global economic factors: Global economic shifts, such as interest rate hikes or geopolitical tensions, can affect the demand for precious metals, causing price volatility.

2. Environmental and Ethical Concerns in Mining

While mining for precious metals drives economic recovery and creates jobs, it also raises environmental and ethical concerns. The extraction of these metals can lead to deforestation, habitat destruction, and pollution. As the demand for precious metals increases, mining practices must evolve to ensure sustainability and ethical responsibility.

Environmental and ethical challenges in mining:

- Environmental degradation: Mining operations can cause significant environmental damage, including soil erosion, water contamination, and loss of biodiversity.

- Human rights issues: In some regions, mining operations have been associated with exploitative labor practices, including poor working conditions and low wages.

Conclusion

Precious metals play an indispensable role in economic recovery, offering stability, investment opportunities, and industrial growth. They help stabilize markets during times of crisis, support industrial demand, and contribute to global trade revenues. By investing in mining infrastructure, governments can foster long-term resilience and mitigate the effects of future economic downturns. However, challenges such as market volatility and environmental concerns must be addressed to ensure that precious metals continue to contribute to global economic recovery in a sustainable and responsible manner.